Housing prices have been climbing quickly. This is especially true in major urban centres where most Canadians live. The rate of increase for the average sale price appears to be climbing faster than people are able to save.

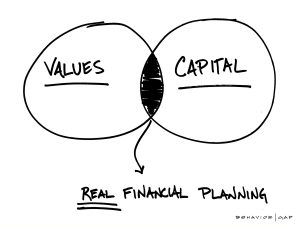

Some Canadians see the dream of homeownership vanishing, others wonder if the choice to own is appropriate for them. No matter the situation, objective analysis should accompany the emotional aspects of buying a home.

What You Need to Know

Regardless of the ultimate choice, affordability is an important decision criterium. No one has ever enjoyed being “house poor”, where little money is left after making your rental or mortgage payment. Based on household income and available down payment a maximum purchase price can be determined.

Every Canadian financial institution has an online calculator to determine mortgage payments. Mortgage providers employ additional analysis tools to predict whether a borrower will repay the lender based on their income, total expenses and financial history. If lenders are reluctant or refusing to provide a mortgage, perhaps the timing is not appropriate, yet.

Mortgage rates have been at the extreme low end of their range for several years as central banks around the world have attempted to revive economies through inexpensive borrowing. When interest rates are low more people and businesses can afford to borrow more. When something is on-sale people buy more, but for borrowing, you cannot decide to delay a purchase when prices rise. Payments must still be made.

At some point rates will rise and some homeowners may not be able to afford their new, higher payments. Before buying their first home, borrowers should ask themselves, “if mortgage rates rose by 2%, would I be still able to afford my payments?”. For example, a $400,000 loan with an additional 2% interest adds $8,000 interest charges per year, or $667 more each month.

That increase would sit atop the existing mortgage payment. The same $400,000 mortgage with a 25-year amortization and 2.25% 5-year fixed rate requires a monthly payment of $1,750. Each additional $100,000 adds another $450 per month to the payment.

Lenders typically limit housing costs to 35% of gross income, acquiring a mortgage will ultimately decide if you purchase and the price. If you earn $100,000 then your maximum housing costs are $35,000 per year. Subtracting property taxes, condo fees and utilities will determine the amount available for mortgage payments. If these costs totaled $14,000, then a maximum of $21,000 would remain for mortgage payments. $21,000 divided by 12 equals $1,750 per month, yielding your maximum mortgage of $400,000.

A down payment is also required; the more the better. At least 10%, but 20% is preferred to keep payments lower. In the examples above with a $400,000 mortgage a first-time home buyer should plan on a down payment of at least $50,000 netting a purchase price of $450,000.

An experiment to determine if home ownership is appropriate is to act as a homeowner while renting. That is, make housing costs equal 35% of gross income. Set aside exactly 35% each month, pay your rent and utilities and the rest goes directly into a savings account, an RRSP or TFSA. Set up the deposit like a monthly bill that is paid automatically. If you are able to practice this disciplined spending/saving approach you are able to live at 35%, if not habits may need to be changed or a more modest home purchase should be contemplated.

Continuing the example of $100,000 income, then $35,000 per year or $2,920 should go toward rent, utilities and savings. If rent is $1,800 and utilities are $150 set up an auto-deposit for $970 each month. At the end of one year, you will have nearly $12,000 more set aside. At the very least this test should increase the amount of your down payment.

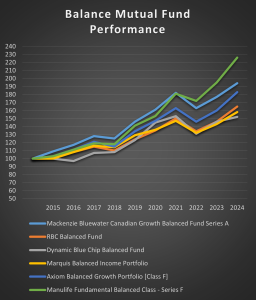

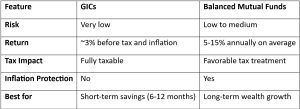

While you are accumulating your down payment the type of investments you purchase and sheltering it from taxes is also important. First time homebuyers can withdraw funds from their RRSPs, for example. Certain conditions apply, of course.

The Bottom Line

A dangerous emotion during a period of rapid rises in house prices is desperation. “If we don’t buy now, we’ll never be able to afford a home” has led many to overextend themselves financially. After that has occurred owning again can be almost impossible.

Couple the dreams of home ownership with objective analysis to determine the best course of action. Prudently investing your down payment in a tax advantaged way is another important aspect of the home buying and ownership experience. We are happy to help with calculations, scenarios, timing, negotiation advice with lenders and investment recommendations.

Book an appointment with us today! – CLICK HERE

![The hardest topic most business owners haven’t talked about [yet].](https://www.ecivda.com/wp-content/uploads/2023/02/the-hardest-topic-1.png)

By: Shawn Todd, CFP

By: Shawn Todd, CFP