A Short List – of Terrible Financial Advice Sayings

By: Shawn Todd CFP

By: Shawn Todd CFP

We’ve all heard terrible financial advice at one point or another.

It might have been in the locker room at hockey, around the coffee machine at work, or even from a friend.

“Your most expensive advice is the free advice you receive from your financially struggling friends and relatives.” – Robert Kiyosaki

“Max out your credit cards to build credit.” This advice suggests that fully utilizing your credit limit will enhance your credit score. In reality, high credit card balances can lead to significant debt and negatively impact your credit rating. Terrible quote. Can really start someone off on a terrible foot.

“You don’t need a budget.” Some claim that budgeting is unnecessary. However, without a budget, it’s challenging to track spending and achieve financial goals, often leading to overspending and financial instability. I see this so many times. 80% of people just don’t take the time to write this out.

“Renting is throwing money away.” This advice implies that homeownership is always superior. However, owning a home comes with significant costs like maintenance and property taxes. Depending on individual circumstances, renting can sometimes be the more financially sound decision. A strong belief by many. Last time I did the math – I believe you are fine renting for about 7 1/2 yrs before seeing a crossover on benefit / cost. So no need to rush. Ownership over long term can help with wealth building in most cases though.

“You should buy as much house as possible.” Encouraging individuals to purchase the most expensive home they qualify for can lead to financial strain, especially if unforeseen expenses arise. This is terrible. I had a friend tell me this in my 20’s and all this mantra did was produce stress to buy a big house. This carries no great value to it,

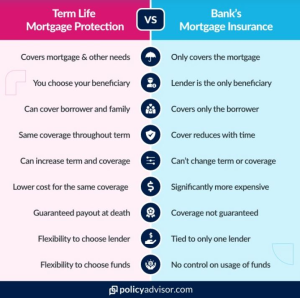

“You don’t need insurance if you’re young and healthy.” Neglecting insurance due to youth and good health overlooks unforeseen events. Accidents and illnesses can occur at any age, and lacking insurance can result in substantial financial burdens. Again terrible advice. Many insurance disbelievers [and there are groups of financial advisers of the same thinking] that minimize needs for insurance, particularly for younger people. Getting approved mid 40’s and 50’s with high cholesterol and heart conditions can be difficult. Having the proper coverage starting young isn’t a bad idea at all.

“Always go for the cheapest option.” Opting for the least expensive choice isn’t always cost-effective in the long run. Investing in quality can lead to better durability and value over time. I see this a lot with investment discussions. I won’t argue the merits of trying to find affordable and cheaper investment options – that’s reasonable. Some believe that cost is the most important part of this conversation on any topic – and this isn’t always true. No matter if you are discussing investment options, insurance, the fee for advice from an accountant, lawyer, or financial planner…or a nice dress shirt. Or flowers for your spouse. And definitely do not take the cheapest rock-climbing course, or scuba diving course. You can see where this is going. If I have an option between a hand made, professionally inspected custom parachute for $500, and a machine made parachute [that everyone else is doing] for $99 that all of the articles assure me do the same thing, sometimes its worth just looking a little deeper at the more expensive parachute. Sometimes.

“You don’t need to save for retirement yet.” Delaying retirement savings can significantly impact your financial future. Starting early allows for compound interest to work in your favor, building a more substantial nest egg. This can really be costly. Delaying too long will back you into a corner that will cost you tens if not hundreds of thousands of dollars more.

“Follow your passion, and the money will follow.” While pursuing passions is fulfilling, it doesn’t always guarantee financial stability. It’s essential to balance passion with practical financial planning. I’m a big follow your dreams guy. I think this speaks to balance. Just opening the door, walking outside and declaring to the world you biggest dream, isn’t going to do it. Passion is important. Paying bills & saving – also important.

“Co-sign a loan to help a friend or family member.” Co-signing makes you legally responsible for the debt if the primary borrower defaults, potentially damaging your credit and financial standing. Scott Terrio – will lose it if I don’t mention this here. This has a small space in the terrible advice section here for a reason. So many make this choice without understanding what this really means. It’s not just a favour.

“You can’t get rich working a 9-to-5 job.” This mindset undermines the potential of disciplined saving and investing. Many individuals have achieved financial success through traditional employment by managing their finances wisely. So wrong. I see lots of manual, very traditional 9-5 job employees have significantly more wealth [monetary, family and life] with their situations. Working endless days does not equal financial freedom. Decision making does.

“Always follow your instincts when making financial decisions.” While intuition can be valuable, relying solely on gut feelings without research or professional advice can result in poor financial choices. We are wrong too often to rely on this. Sometimes the gut check is a big saviour. Sometimes it also will devastate you. This is where all those buying into weed stocks should please leave a comment below.

“You should get a credit card as early as possible to build credit.” While establishing credit is important, obtaining a credit card without understanding responsible usage can lead to debt accumulation and financial mismanagement. Credit is important. Living under debt =not important. Please be cautious.

“Investing is only for the wealthy.” This misconception prevents many from taking advantage of investment opportunities. Starting with small amounts can lead to significant growth over time through compound interest. Growing up, the only people I saw who invested were the ‘wealthy’. I feel this is where good planning, and good advice fits it. There are so many who should be investing, to build their own wealth. It’s often a missed strategy for so many.

“You should always aim to retire with $1 million in the bank.” Setting an arbitrary retirement savings goal without considering individual lifestyle, inflation, and future needs can be misleading. Personalized planning is essential. What will help someone else’s situation, may not help yours. This might work if you have no debt, and a decent lifestyle. If you are a spender, and carry debt, and want to retire earlier – this advice won’t be helpful.

“Borrowing from your retirement fund is a good way to handle short-term financial needs.” Tapping into retirement savings can jeopardize your future financial security and incur penalties, making it a risky short-term solution. Ripping out long term money to pay off the hot tub, vacation, or house reno you just did is terrible decision making, and bad advice all around. That $10,000 you removed from your RRSP at age 30 to do one of the above – will only get you $7,000 in your pocket, and would have potentially grown to $76,122 by age 60. That was costly.

I’d never shy away from listening to advice around the coffee shop. Great friends, great people – they all want you to hear what they have done. Listen, learn, act wisely.

My thoughts on this today –

![The hardest topic most business owners haven’t talked about [yet].](https://www.ecivda.com/wp-content/uploads/2023/02/the-hardest-topic-1.png)

By: Michael Lutes CFP, CLU

By: Michael Lutes CFP, CLU