6 Money ‘Rules’ You Should Follow

Financial experts reveal the advice that they personally make sure to track their spend in their own lives. There are many ways to achieve this. Here are their top six:

1. Have one main investment account and another for short- to mid-term needs

Most people who have at least one long-term [investment] account should consider opening another account for mid-term goals. Mid-term goals might involve buying a house or paying for a child’s education.

Match your portfolio spending to the specific goals and time horizon.

2. Don’t be too restrictive with your budget

Trying to change your spending habits too quickly can result in burnout. Make room for expenses that matter to you. If an activity with a friend is a priority, keep this in your budget. Find other ways to cut down on spending; like canceling unused subscriptions.

3. Automate saving money

You should automate everything you can about saving so that you don’t have to make a conscious decision to do it. Money in a checking account can be tempting and easy to spend. Make regular transfers to a high-yield accounts that can help you save for an emergency.

If applicable, automatically transfer your money to a retirement account. If you work for a company that offers a shared RRSP plan, it’s ideal to sign up for the full employer match. Not taking advantage is like leaving hundred-dollar bills on the ground.

4. Spend more to save more

Focus on quality and spend more if it means it will last. For big-ticket items take advantage of sales events and/or buying seasonal items at the end of the season. Participate in free loyalty programs and search for online coupons before making a purchase.

5. Look out for the small purchases on your credit card statements

When reviewing your credit card statements, it’s easy to just focus on the bigger charges. But it’s key to also review the smaller line items.

These purchases are easy to overlook. Check your statements monthly, and if you see something you don’t recognize (even a few-dollar charge), report it to your credit card company immediately.

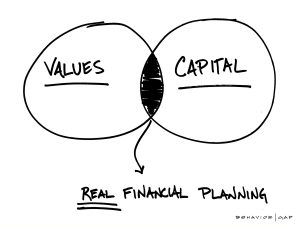

6. “One-size-fits-all” approaches doesn’t work

Personal finances should be based on your values. Once you understand that other people’s priorities are not the same as yours, you will be able to make the most sense of the right savings methodology for you.

The question becomes: What is important to you may differ from your neighbours and friends.

Bottom Line

There are a lot of rules of thumb out there when it comes to money, but don’t feel pressure to follow them all. The best thing you can build into your personal financial plan is the flexibility to make changes as needed.

One of the things that strikes me as incredibly common about both my experience, and the experiences that I have had with clients, is that its difficult to talk about what might happen if we get sick, or if we die. It’s terrifying.

One of the things that strikes me as incredibly common about both my experience, and the experiences that I have had with clients, is that its difficult to talk about what might happen if we get sick, or if we die. It’s terrifying.

By: Michael Lutes CFP, CLU

By: Michael Lutes CFP, CLU