GICs vs Balanced Mutual Funds

Why GICs Are Only for Short-Term Investments—and What to Choose Instead

By: Rushit Goyani, RFRA

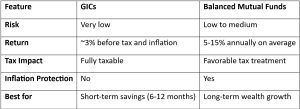

Guaranteed Investment Certificates (GICs) are often seen as a safe way to grow your money. They offer guaranteed returns, making them attractive to risk-averse investors. But when you consider taxes and inflation, the real return on GICs is often disappointing.

The Hidden Reality of GIC Returns

A 1-year GIC may show a 3% return on paper, but once you factor in taxes and inflation, the real value of your money remains stagnant—or worse, declines. This is because:

- Taxes eat into your interest earnings.

- Inflation reduces your purchasing power.

- Over time, your money doesn’t truly grow, but simply maintains its value at best.

If your goal is purely capital preservation for the short term (6 months to 1 year), GICs can be a viable option. However, for long-term growth, they are not the best choice.

Balanced Mutual Funds: A Better Alternative

For investors seeking a similar risk profile to GICs but with better long-term growth, balanced mutual funds are a great alternative. These funds invest in a mix of stocks and bonds, providing moderate growth while minimizing volatility.

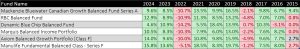

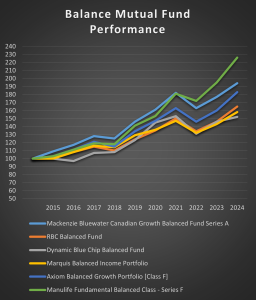

Let’s take a look at some real balanced mutual fund performances over the last nine years:

- Low Volatility: Out of nine years of data, balanced mutual funds have had only 2 to 3 years of negative returns.

- Strong Growth: A $100 investment in 2015 would have grown to between $150 and $220 by 2024, delivering an approximate return of 50% to 120%.

- Medium to Low Risk: These funds balance safety with reasonable returns, making them a great choice for long-term investors.

Comparing GICs and Balanced Mutual Funds

Final Thoughts

While GICs are great for preserving capital in the short term, they do not provide meaningful growth over time. If you want your money to work for you while maintaining a conservative risk profile, balanced mutual funds are a much better alternative. With historically strong returns and limited downside, they offer an excellent way to grow your wealth over time while still protecting against major market downturns.

Before making an investment decision, consider your financial goals, time horizon, and risk tolerance. But if you’re looking for growth without excessive risk, balanced mutual funds are a smarter choice than GICs.

Book an appointment to talk to us today! CLICK HERE

By: Shawn Todd, CFP

By: Shawn Todd, CFP

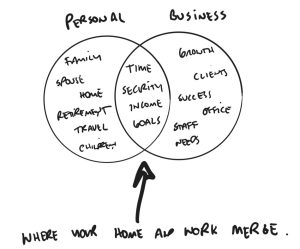

By: Michael Lutes CFP, CLU

By: Michael Lutes CFP, CLU