Corporate Investments – Getting active around passive income.

By: Michael Lutes CFP, CLU

Certified Financial Planner

Introduction

In Canada, the taxation of passive income earned by corporations has been a topic of interest and debate for many years.

The rules and regulations surrounding this income have evolved, impacting how businesses manage their investments and financial strategies.

In this blog post, we will delve into the essentials of Canadian corporate passive income, including what it is, how it is taxed, and strategies for optimizing your corporate investments.

What is passive income?

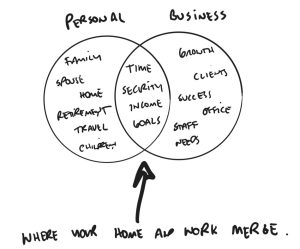

Passive income refers to the income earned by a corporation from investments in assets such as stocks, bonds, rental properties, and other passive sources. This income is distinct from active business income, which is generated from a corporation’s core business operations.

Common types of passive income include:

- Dividend Income: Earnings received from investments in shares of other corporations.

- Interest Income: Earnings from investments in bonds, GICs, or loans.

- Rental Income: Income generated from leasing out real estate properties.

- Capital Gains: Profits realized from the sale of investments, such as stocks or real estate.

How is passive income taxed?

Taxation of passive income is governed by the Canadian Income Tax Act. The key principle is that passive income is subject to a higher tax rate compared to active business income to discourage corporations from accumulating excessive passive investments.

Moreover, having too much passive income in any given year will reduce or eliminate a corporation’s access to the following year’s Small Business Deduction, the effect of which can be an additional approximately 15% income tax.

Strategies for managing passive income

To minimize passive income and avoid the potential loss of the Small Business Deduction, business owners should consider the following strategies:

- Withdraw additional funds for investment in RRSP or TFSA accounts.

- Use accumulated Capital Dividend Account (CRA) credit to withdraw funds tax-free and reduce potential for passive income.

- Remove funds tax-free by having the corporation repay any outstanding shareholder loans.

- Focus on capital gains-oriented investment. Unlike interest and dividend income which is earned regularly and taxed in the year it’s received; capital gains can be realized strategically and only 50% of capital gains are included in income.

- Let your winners ride! In other words, if you have unrealized capital gains, you might consider hanging on to them until a future year when you may avoid a further reduction of your SBD. Or hang on and sell them in a year when you already have greater than $150,000 of passive income and have already eliminated the SBD anyway.

- Spread out your gains. Instead of deferring capital gains to future years, sell your winners over two or more years to potentially avoid reducing your SBD.

- Implement an Individual Pension Plan (IPP). An IPP is essentially a business owner’s very own defined benefit pension plan. The money contributed is eliminated from the calculation of passive income.

- Buy permanent life insurance inside the corporation. The investment income is sheltered inside the policy as “cash value” and doesn’t count to the calculation of passive income. Furthermore, on death the entire death benefit can often be paid out to shareholders tax-free.

- Donations from a corporation will reduce the funds that would otherwise be producing passive income. Further, if donating securities or funds with unrealized gains, there are additional benefits such as no tax payable and a credit to withdraw funds from corporation tax-free.

Conclusion

Understanding Canadian corporate passive investment income and its taxation is crucial for businessowners looking to optimize their financial planning strategies. By staying informed about the rules and employing effective tax planning strategies, businessowners can strike a balance between accumulating passive investments and managing their tax liabilities. Consulting with a qualified tax professional or financial advisor is often recommended to navigate the complexities of corporate taxation in Canada effectively.

![The hardest topic most business owners haven’t talked about [yet].](https://www.ecivda.com/wp-content/uploads/2023/02/the-hardest-topic-1.png)

By: Shawn Todd, CFP

By: Shawn Todd, CFP

By: Corey Butler, Wealth Advisor

By: Corey Butler, Wealth Advisor

By: Shawn Todd, CFP

By: Shawn Todd, CFP

By: Brian Adams CLU, C.H.F.C.

By: Brian Adams CLU, C.H.F.C.