By: William Henriksen, CFP

Congratulations! Officially becoming the professional that you studied so long to become is an amazing achievement and that deserves to be recognized! The path to becoming a professional such as a doctor, dentist, or lawyer requires almost a decade of post secondary education or more. Take a moment here to acknowledge your achievement. Think of all the work you’ve put into those years and think of all the various paths you can take your career from here. It’s exciting, scary, stressful, and wonderful all at once. Let’s explore how you can best position yourself for the future.

Managing your cash flow as a professional

The moment you start making an income, you begin feeling the biggest cashflow flip that you’ve ever had. This is where you have an opportunity to set up a great habit for yourself by creating a budget that incorporates your values, priorities, and the wellness of your future self.

Things to consider when creating a budget:

- Your fixed expenses: This establishes a baseline for all future lifestyle expenses so be careful.

- Your insurance premiums: If you are running your own practice you may need to get individual insurance and should factor the premiums into your budget early on.

- Your savings rate: How much should you be putting away for your future self and for your long-term goals? Do you have an emergency fund in place and how much should you aim to have in it? The amount will vary from person to person and should be discussed in the context of your unique goals and situation. As a professional, keep in mind that you will likely need to fund your own pension as you may not have an employer to fund a pension plan for you.

- Debt repayment: Many professionals come out of school with significant student debts. Should you focus on paying it down first? If so, how aggressively? This will also depend on your unique situation.

- Automation: Having all the above automated will create the possibility to implement point number 6.

- Guilt-free spending: What’s left over in your budget is non-allocated money. In the real world the amount will vary from month to month depending on how often you get paid, but if you’ve automated everything to come out on the same date, once it’s past you can confidently spend money that’s left over with a clear conscience because you will have already allocated money to pay your fixed expenses, protect your income, health and family through insurance, and you will have paid yourself through saving and debt repayments. If the amount you’ve allocated to points 1-4 allow you to reach your goals, the amount left over can be spent guilt free.

- Reviewing regularly: Keep in mind that being financially organized is a continuous process, so learning and adapting your strategies as your financial status evolves is key.

Following these steps and living below your means is a huge step toward reducing the stress or uneasiness you may feel about your financial situation. It will also have the effect of increasing your confidence that you’re doing the right things to align your capital with your values and priorities.

Protecting your future self and your loved ones

It’s easy to avoid thinking about what happens if life doesn’t go the way we plan because we don’t want to believe bad things can happen to us. We tend to avoid difficult conversations until we’re prompted to have them. As a planner I have a responsibility to have these kinds of conversations with clients when evaluating their insurance needs. More often than not, people don’t know what would happen if they got sick or injured to an extent where they can’t work to receive an income. They aren’t sure if they would be leaving enough financial support for their loved ones should they pass away. Ask yourself now, what kind of financial impact would something like that have on you and your family? Without insurance, your potential income you’ve studied for would go down to zero. If you passed away, those who depend on you may be left with financial hardships. You may want to consider if your current needs are going to change down the road and structure your insurance to account for those potential needs. Disability insurance, life insurance and critical illness insurance are ways to ensure that you and your loved ones will be financially taken care of if you’re faced with such events which are out of your control.

A common reason people avoid looking into insurance early on is that they believe it will be too expensive. This doesn’t have to be the case. Not only does it cost less to get insurance the younger you are, but you can also structure insurance plans as starter policies that are easily graduated into more robust long-term policies later. This keeps costs low until you have a handle on your cash flow and protects you right away with the coverage you need. If your insurance need today is relatively low compared to what it will become, you may want to have the option to buy more later when your situation changes without needing to prove you’re insurable. This is possible and should be discussed when evaluating your insurance needs.

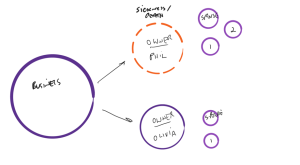

Incorporating

As a young professional, you may be considering starting your own business or working as a freelancer. If you plan to grow your business, you may want to consider incorporating. Incorporating means creating a corporation, which is a separate legal entity from its owners.

Why should you consider incorporating? Here are some reasons:

- Limited liability protection: One of the main benefits of incorporating is limited liability protection. As a corporation is a separate legal entity, the corporation’s creditors cannot go after your personal assets. This means that your personal assets are protected from any lawsuits or debts incurred by the corporation. This can be particularly important for businesses that are exposed to higher risks or liabilities.

- Tax advantages: Another benefit of incorporating is tax advantages. A corporation pays corporate income tax on its profits, which is typically much lower than personal income tax rates. Additionally, as a corporation, you are subject to many different rules that create opportunities for various tax planning strategies.

- Insurance strategy benefits: Incorporating can also provide benefits for your personal insurance strategy. When I mentioned graduating your insurance policies earlier, this would be the place to graduate them to. Some of them anyway. This point could be an article on its own and is not the focus for today, but seeing the full game plan from a bird’s eye view can make the action plan for your current stage easier to understand.

- Credibility: Incorporating can also enhance your business’s credibility. It shows that you are serious about your business and committed to its success. It can also give your business a more professional image, which can help attract more clients or customers.

- Access to capital: If you plan to raise capital to grow your business, incorporating can make it easier to do so. Corporations can issue shares or bonds to raise funds, which can help you grow your business faster.

However, incorporating also comes with some drawbacks:

- Higher costs: Incorporating can be more expensive than other business structures. You will need to pay fees to incorporate and file annual reports with the government. There may also be legal fees associated with incorporating.

- More paperwork: As a corporation, you will need to keep detailed records and file annual reports with the government. This can be time-consuming and requires a higher level of record-keeping than other business structures.

In conclusion, incorporating can be a smart choice for young professionals who want limited liability protection, tax advantages, insurance strategy benefits, credibility, or plan to raise capital. However, it also comes with higher costs and more paperwork. If you are considering incorporating, it is important to speak with a financial professional or legal expert to determine whether it is the right decision for your specific circumstances.

Creating Options

All things considered, there are a lot of big topics to approach at this stage of your life and of your career. You likely have some degree of uncertainty regarding the future and it’s very possible that your life changes significantly in your early career as you juggle your personal goals and your professional ones. To get off to the best start, and to account for these possible changes, it’s important to create options for your future self. Finding the right financial planner for you, creating a budget, getting the right type and amount of insurance in place, and working with your planner and their team to build your vision are the best things you can be doing now for your future self. Your future you will thank you!

If you would like to discuss this – book an appointment with us, we would love to hear from you!

![The hardest topic most business owners haven’t talked about [yet].](https://www.ecivda.com/wp-content/uploads/2023/02/the-hardest-topic-1.png)

By: Shawn Todd, CFP

By: Shawn Todd, CFP

By: Corey Butler, Wealth Advisor

By: Corey Butler, Wealth Advisor