What is a Financial Plan?

Executive Summary

A financial plan is like a roadmap to achieving the financial future you envision. It starts by identifying where you are financially and provides directions for getting to where you want to go. There are many areas that make up your finances: your assets and liabilities, investment portfolio, cash flow, tax situation, retirement income, insurance and estate plan (or lack thereof).

Your lifestyle also plays a role. For a financial plan to be effective, each one of these areas must be addressed in a coordinated way to provide a personalized, comprehensive financial solution.

What You Need To Know

As with any goal or strategy, a financial plan must have objectives. How do you see yourself five, ten or 20+ years in the future? After determining your current financial state in the areas mentioned above, you will need to establish a clear vision to start creating and implementing a plan. This includes what your retirement lifestyle will be, because only then can you determine needs for investments and income. If you have children, it may also include funding for their education or other endeavors.

Once you’ve clarified your current financial situation and understand your vision for the future, calculations can then be made to determine how your assets need to grow to reach those goals. This will determine the investment plan that you’ll need to produce the necessary returns from your assets.

A comprehensive financial plan must also consider the tax ramifications of your finances and identify strategies to minimize your tax liabilities. Additionally, your financial plan should mitigate risk and protect your wealth using tools such as insurance products. The use of insurance can also be beneficial in your estate plan, as there are ways to minimize taxation and maximize the wealth of your estate.

If all this sounds a bit complex or outside of your comfort zone, consider working with a financial advisor. Find someone who understands the implications that each area of your financial plan has on achieving the goals you’ve set. He or she may need to liaise with other professionals, such as your lawyer or accountant, to do a complete and thorough job.

Bottom Line

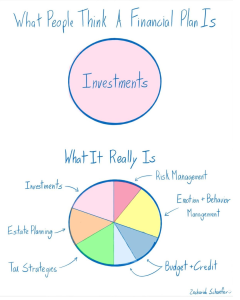

A proper financial plan is more than managing your investments, creating tax minimization strategies or planning for your retirement. It is all these things plus others, including risk management (insurance) and estate planning.

A comprehensive financial plan requires the coordination of all these areas to maximize the wealth potential from your current financial situation. It begins with setting clear financial goals and working through all the aforementioned areas. This is generally best done by working with a capable financial advisor, as all these areas must be addressed in a coordinated way to create an effective, holistic financial plan.

Book an appointment with us to get started on your financial plan today! CLICK HERE

By: Louai Bibi, Advisor Associate

By: Louai Bibi, Advisor Associate