By: Shawn Todd, CFP

By: Shawn Todd, CFP

Just before the New Year of 2023 – I was fortunate enough to go for a short adventure trip with my wife Michele, where we planned to do some extraordinary hiking in Arizona. The first thing I did when I packed for my trip on the days we hiked – was making sure that I had packed a GPS, a compass, enough water, and had a plan. It sounds simple, but you’d be surprised on how many people venture out with just their shoes. I saw many with no gear, or the wrong gear.

Some short stats:

- 57.8 million hikers every year in the US.

- There are 4 deaths per 100,000 hikers

- 70% of hikers who die are male

Looking at these stats – right away it becomes a very good message to me that not only should I be careful, but I should always be packing a compass. I’m male, I hike, I Iove my wife and family, and I’m planning a hiking trip.

When it comes to our personal lives, and our business lives, it’s very easy to overlook what you need to be packing in your ‘day to day’ backpack. It’s very easy to be comfortable with life ‘as it is right now’. The home & your after-hours routine, and your work & your normal ‘day at the office’ routine all flow one day to the next without any issues. Sometimes we neglect how each of these affects the other. How impactful our personal lives are with our work, and how significant a role our work plays in providing comfort in our personal lives.

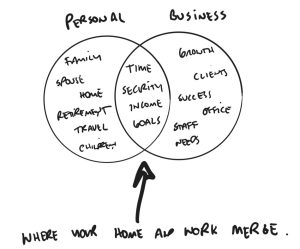

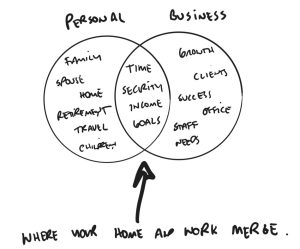

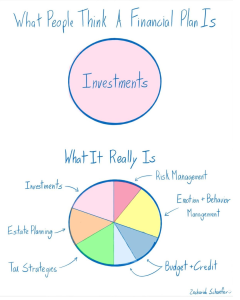

The merging of our personal and business lives give way to four key themes on this Venn diagram above. These dual areas are:

Time – how much time can we spend with our loved ones, what kind of quality time is it? How much flexibility does our business provide us, how hard have we worked to have it be this way?

Security – Our business without questions provides the security for us to make decisions that affect our spouse, our children and ourselves. Where are the children going to post-secondary school? Do we need to have two incomes or just one in the home? What will happen if one of our family is sick and needs care? Does our life feel safe and secure?

Income – We all start off with a life wanting to not be only concerned about money. You may be more interested in your community, in charity, in just time with loved ones. The income that comes in now, and the income that may or may not come in – if you weren’t working – will impact most of the decisions we make with the other three areas – time, security, and our goals.

Goals – This is where it’s always interesting. Every single person has different goals, different needs, and different wants. Spending a great deal of time here, really helps with a good foundation to mapping out where we want to go in life [and mapping out what trails we want to explore on that hike]

Many times, when we meet new clients – and we ask – “would you like us to spend time doing financial planning for you personally, and also for you corporately?” they may feel initially positive about it, but also feel slightly tentative about planning twice. Why would I need to do this?

Some more short stats:

- 96 percent of small business [with 1-100 employees] survive for one full year

- 70 percent of small businesses [1-100 employees] survive for five full years

- There are over 1.3 million businesses in Canada with employees

- Small businesses provide over 70% of the total private labour market

- A healthy growth rate for a small business should be between 15%

- A business will double in 5 years at a 15% growth rate

- 350 people out of 100,000 [ages 45-49] will be diagnosed with Cancer [87 times the chance of dying hiking]

- 1,000 people out of 100,000 [ages 60 and older] will be diagnosed with Cancer [250 times the chance of dying hiking]

Spending time planning can’t take away all the risks of business failure, of financial stressors, or of getting a critical illness that impacts your business. It certainly can help make you aware of your blind spots. Having an opportunity to see the risks, whether they are in your investment portfolio, in providing enough retirement income, or possibly in your business structure – really help make you more aware of your current situation, and your future situation combined. You wouldn’t go on a hike without the proper gear, and I wouldn’t suggest you tackle life and business without the proper gear.

Take the time to review your own strategy and plan. If you’re unsure on areas, or need guidance, consider having a finanical plan completed, or updated. Keeping both your personal and corporate worlds safe is key. If you need to pack a compass to stay on track, I’d certainly recommend doing so.

Just my thoughts for the day,

Shawn Todd, CFP

By: Shawn Todd, CFP

By: Shawn Todd, CFP