Not today. Why we don’t like thinking about risk.

By: Shawn Todd, CFP

Many of you will know that throughout my life, I haven’t minded risk at times. Before I was 35 yrs. old, I was a police officer, I was a diver with the OPP Underwater Search and Recovery Unit, and I was an Explosives Disposal Technician. I’m currently a business owner [a lot of business owners have an appetite for risk]. I downhill ski, I have a motorcycle, and I’ve climbed Kilimanjaro with my spouse Michele.

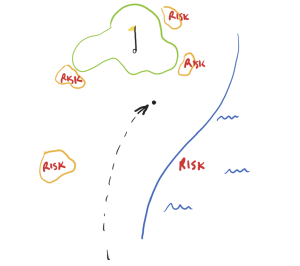

I imagine many of you have your own interests. You enjoy sailing, or camping, or travelling overseas. Flying to see family, swimming at the cottage, or having a steak on the BBQ. Some may enjoy biking in the city, ice skating on the canal, or smoking a cigar. Risks show up all over, and we all don’t enjoy talking about it. We like the excitement of a ski weekend getaway in Tremblant, but we don’t enjoy talking prior to the trip about the potential of breaking our leg.

When I first came into the financial planning and advisory business eighteen years ago, that version of myself believed that insurance would be the least interesting part of my work. I spent hundreds of hours researching investment portfolio theory, financial planning, marketing, building a business, but the very last thing that I felt was needed by most up and coming young professionals was some of the insurance products that I was learning about.

I was dead wrong.

Five years into my financial planning career I had a terrible ATV accident while out with friends and clients. I broke my back in five places, split my liver, broke three ribs, tore my adrenal gland and almost died in a field in Calabogie, Ontario. It was the scariest moment of my life. I had just met the person I have always wanted to be with, and I had children to care for.

Today, eighteen years after beginning as an advisor, I have had had several important and close clients experience terrible and demanding situations. I’ve lost some great clients and friends to a variety of illnesses, accidents, and situations. No one was planning on not being here in 20 years.

One of the things that strikes me as incredibly common about both my experience, and the experiences that I have had with clients, is that its difficult to talk about what might happen if we get sick, or if we die. It’s terrifying.

One of the things that strikes me as incredibly common about both my experience, and the experiences that I have had with clients, is that its difficult to talk about what might happen if we get sick, or if we die. It’s terrifying.

In my time as a financial planner, I have picked up a great deal of more experience and knowledge since my beginning days as a new advisor. I have seen well planned out life insurance policies provide enough income to a family after the unexpected loss of spouse. I have watched planned gifting to children and grandchildren that has allowed full lives after a loved one’s passing. Business owners have used it to ensure security while their business started, and while success ebbed and flowed. Professionals have used it to protect their occupation and income. Tax planning has allowed it to be used as a formative tool in dealing with business owners, passive income strategies, or dealing with terminal tax.

There are a few distinct things that talking about risk, and protecting ourselves, can provide.

- It can remove a lot of stress from your life. No more worrying about what happens [even if you don’t want to talk about it normally]

- It can help provide income to you or family members if you are sick, injured or die.

- Some may be able to pay off debts.

- During key parts of a financial plan, it can provide a great deal of stability for income and assets needed to achieve goals.

- It can be used as an opportunity to diversify how you invest or use business capital.

- Its usage may help in minimizing taxes – both now, and later

- During business growth periods it can provide a great deal of security to the business, the shareholders, and their families.

- For some it can offer an ability to gift to children, grandchildren, or even charities that are important to you.

While 92% of people believe talking with family and loved ones about the end of their life is important, only 32% do. [ Seattle Times – “Why don’t we talk about death” May 2019]

To conclude…

It may well be time to begin opening the conversation about your own risks. What risks do you have in your life that you are most concerned about? How would they affect your financial plan, or financial integrity? Are there opportunities you should consider for your business, your own portfolio, our own situation? If you didn’t speak about your risk concerns – would the situation have changed for the worse of the better in ten years time?

Speaking about risk, and what may come may be difficult for most. There is never a better time to start this conversation than today.

Just my thoughts for the day.