Hitting more Fairways & Success in investing.

By: Shawn Todd, CFP

Most of us have golfed at one point or another during our lives. It may have been once, or it may have been many times throughout the summer. No matter how often you have golfed you will always remember the feeling of a firing a shot into a bunker [when you were going for the green], or just firing a ball into the water on a par 3. It’s tough, and it really starts to take the fun out of the game.

Most of the people reading this will have also invested at one point. Your home is one of your largest investments, and you may have several other investments in your portfolio. If you’ve been doing it as long as I have, then you also will have memories of the tech wreck, the financial crisis, and the market correction during Covid.

What does golf and investing during these market corrections have in common?

A well thought out gameplan.

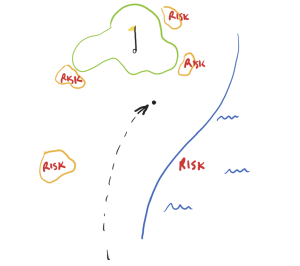

If we approached golf without any consideration for the inherit risks of the game, well we would just feel the consequences. We’d lose a ball here, bogey there, it would be a miserable experience. Some of us all can feel that pain. Playing the game more smartly, hitting more fairways, staying out of the bunkers, well of these efforts make for far better results.

Investing needs to be focused, and well thought out. Ensuring you understand the risks of the portfolio you are in, the timelines you have, the goals of each portfolio, and the risk of each investment in your portfolio; is incredibly important. There needs to be a well thought out plan for taxation, capital gains [this is the topic of the day – thanks to the recent budget], and a discussion of the solutions that make the most sense for each investor. Often what works for you, may not be what works for your neighbour or colleague. Like golf, we all have different risk tolerances, capability, and performance needs. You need to play your own game, and your own pace.

Unlike golf – there are some great opportunities that will enhance your experience. Portfolio management, risk management, diversification, and a deep understanding of your needs – will all allow for an exceptionally smooth ride.

Imagine golf is someone could just tap your shoulder right before you started your ill-fated swing and said – “I just wouldn’t take that shot”.

It might make the game a lot more fun.

Consider helping your investing experience by adding a professional wealth management team to help you understand your own gameplan.

My thoughts for the day.